According to Michael Kokalari, Chief Economist and Head of Research at VinaCapital, the recovery in exports has had a positive impact on many sectors of the Vietnamese economy, contributing significantly to the 5.7% GDP growth in the first quarter of this year.

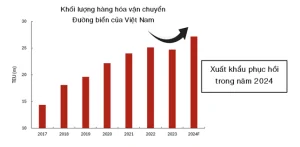

Exports began to recover from mid-2023, leading to increased capacity at ports in Vietnam. VinaCapital expects Vietnam’s export recovery to continue beyond this year. The strong U.S. economy is driving exports across Asia, with U.S. imports growing at a remarkable rate of 7% in the first quarter and likely to continue strong growth this year.

In April, the “new orders” index of the global emerging markets PMI by S&P reached its highest level in over three years, with the number of new orders in Vietnam reaching the highest level in nearly two years.

“We emphasize that the revenue from air and sea freight handling services of Vietnamese logistics companies also earns significant revenue from freight transport, in addition to handling service revenue. VinaCapital expects the overall revenue growth of these companies to remain nearly unchanged this year, despite the strong growth in shipping activities and higher port handling fees,” said Michael Kokalari.

Additionally, Vietnam’s export recovery is driven by increased exports of high-tech products, which are often transported by air. According to VinaCapital, the growth in air cargo volume in Vietnam (approximately 40% year-on-year) far outpaces the growth in sea cargo volume (approximately 30% year-on-year).

Exports of laptops and other household electronic products have increased by more than 30% year-on-year in the first five months of the year, double the overall export growth rate of 15%, supporting the current foreign direct investment (FDI) inflows from high-tech product manufacturers.

Finally, the supply of available industrial land is limited. The occupancy rate at industrial parks in the North, which attracts most of the new high-tech FDI, is currently averaging over 80%, and the occupancy rate at industrial parks in the Ho Chi Minh City area is over 90%. The combination of being less affected by prices for high-tech product manufacturers and high occupancy rates has driven industrial land rental prices in the North and South to increase by 35% and 15% respectively last year.

By Duy Quang

Tien Phong